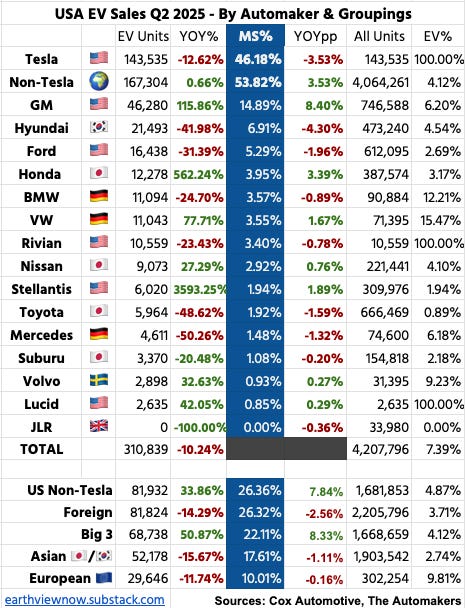

Q2 US EV Sales - GM Soars, Tesla Stumbles, and Stellantis Enters the Fray

United States battery electric vehicle (EV) sales took a step back in the second quarter of 2025, declining 10.24% versus the same period last year. The decline was led by Tesla (TSLA), whose controversial founder has saddled it with a unrelenting branding crisis and Ford (F), which in Q2 struggled with recalls affecting its most popular EV models.

Despite the overall decline, there were eye-searing bright spots in this quarter’s numbers. Sales for General Motors (GM) EVs soared 115.86% as demand for Cadillac, Chevy and GMC branded electric SUVs boomed. Cadillac sales are now 26.6% EVs, bringing the storied Detroit luxury brand to European levels of electrification.

GM’s success looks even more spectacular when one considers that all of Honda’s EV sales are from selling rebadged GM vehicles under the Honda and Acura marques. If those vehicles are considered, GM’s EV platform now accounts for nearly 1 in 5 electric vehicles sold in the US - a higher market share than GM has in gas vehicles.

Sellantis (STLA) also entered the US EV wars seriously in Q2 with the introduction of a fully electric Jeep Wagoneer to sit alongside its Dodge Charger EV muscle car. The Euro-American owner of Chrysler, Dodge, Jeep and Ram intends to increase its electric offerings substantially with two new models launching by the end of the year.

As for the US-based all electrics, Rivian (RIVN) sales have stalled as buyers await its smaller more affordable models scheduled for next year. Lucid (LCID) continues to struggle to find buyers for its impressive products. And Slate - which focuses on small, modular pickups - has yet to get to market.

Of the foreign automakers, Hyundai (HYMTF) experienced a dramatic 41.98% drop due to a mixture of model changovers, tariff pressures, and customer demand shifting to its extensive hybrid offerings.

Ford and Hyundai’s battery electric stumbles have catapulted GM’s into a clear second position behind Tesla. And it has enormous room to grow. Electric vehicles make up only 6.2% of GM’s US sales, and its full EV lineup has yet to be rolled out. The company has no small EVs available (the popular Chevy Bolt is off the market and scheduled to make a return early next year). And one of its major brands - Buick - lacks an EV model entirely. If Tesla is ever overthrown as the US’s top-selling EV automaker, a more electrified General Motors will likely be the one to do it.

Tariffs will continue to loom over the entire American automotive market in Q3 2025. But the recent elimination of the EV tax credit by Congress has given automakers some policy clarity. Q3 is expected to be a blowout quarter for EVs in the US as automakers ramp up their sales pitches to customers looking to buy before the credits expire in October.

Q3 is also set to see the introduction of the new Nissan Leaf, a small crossover SUV which has been getting rave reviews and may revive the fortunes of the once pioneering EV nameplate.